Anything with a half eaten Apple printed on it seems expensive, especially the company itself. The iPhone XS starts at around $1,000 USD and goes up from there. Most people think of computers when they think of Apple. Yet from a business perspective, the company has been a smartphone powerhouse.

At least that has been the case until this year.

Here’s the problem: smartphones are carrying the company’s profits. There is a tremendous amount of competition in the smartphone market. Earlier this year Huawei overtook Apple as the world’s second-largest seller of smartphones, but the stock market just keeps bidding Apple shares higher (apart from the stock selloffs yesterday that saw all major tech companies take a sudden downward turn and Apple (AAPL) down almost 3.5%).

Long Way Down

Apple is valued at more than $1 trillion USD. Their trailing price to earnings ratio has climbed to around 20 over the last few months. A price to earnings ratio of 20 isn’t abnormally high, but it isn’t exactly at value levels either.

Other massive technology companies, like Amazon (whose price to earnings ratio is north of 140), are trading at stupefying levels. Apple’s valuation isn’t nearly as high, but they are highly vulnerable to a substantial drop in earnings. They rely on the Western world to support a business model that may not be able to adapt to the next phase of global growth.

Taken together, these two factors make Apple unattractive as a stock.

Big technology players around the world are highly leveraged to continued consumer growth and a stable financial system. Apple’s presence in the Chinese market has been suffering. Right now Chinese tech heavyweights are expanding into their own nation and other growing markets across Asia.

Apple has depended on Chinese consumers for more than a decade, now they seem to be coming up short. This isn’t great for a business that is highly leveraged to global consumer spending and is able to maintain their valuations because of an accommodative central bank policy.

Wall St. Loves Apple (Which Isn’t Great)

Another reason to avoid Apple shares relates to their relentless rise in value over the last decade. Major investors have made a lot of money on AAPL. The overall economic picture has been looking less stable all year, so sticking with a stock that has lots of profit locked up may be difficult for some investors.

Tech mega caps like Google have risen to earnings multiples around 50, which seems optimistic with Syria heating up again, and an uncertain interest rate situation in the USA. If there is any sort of problem in the global markets, tech heavyweights might be first on the chopping block.

The recent uncertainty in government debt been hard on global markets, imagine what would happen if there was an even larger negative surprise!

Expensive Money is Bad for Growth, and Consumer Spending

Interest rates are still at ultra-low levels around the world. Last week a decent jobs print in the US sent the 10-year yield to levels that haven’t been seen for years. There has also been a string of hawkish statements coming out of the US FED, which could mean a tighter monetary policy in the world’s largest economy.

Apple relies on a consumer that has easy access to high levels of disposable income. In a world where their competition is expanding rapidly, Apple’s business model looks increasingly questionable. Despite the recent higher-than-expected jobs print in the US, the vast majority of US consumers have less money to buy toys than they did a few years ago.

Apple Isn’t a Compelling Story Anymore

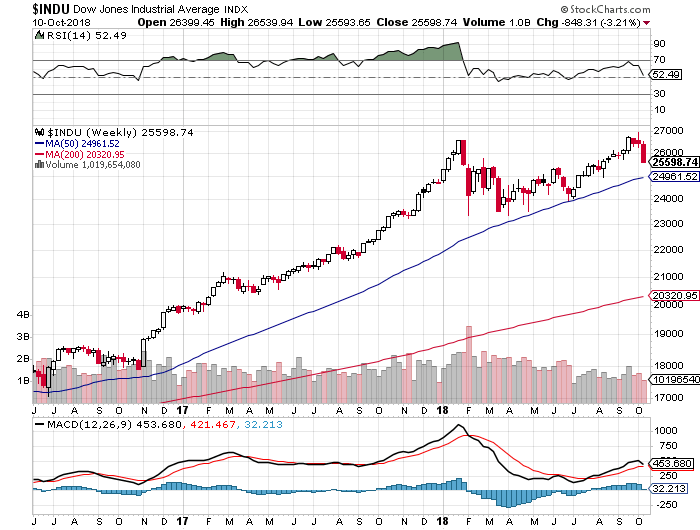

A short glance at a weekly chart for AAPL will show that the MACD indicator is at elevated levels, and the RSI is approaching overbought territory. This chart isn’t a slam-dunk short, but it should give anyone who is holding AAPL second thoughts. AAPL shares have been on a winning streak for more than a decade, and there are sure to be some fat profits waiting to be locked-in.

It is possible that APPL shares will continue to increase in price for a short time, but when the next round of selling comes to the markets, it would be wise to either be out of your position or at the very least sell some calls to offset your potential mark-to-market losses.

Over a longer-term, Apple may be in for a rough ride.

Apple’s core computing business hasn’t generated enough profit to justify their valuation in a long time. As a smartphone manufacturer, they aren’t in a great position. The company sells an expensive product that has a hard time competing outside of the US.

Apple was able to expand in China for many years, but today companies like Huawei and Xiaomi are displacing Apple. The last 20 years have been amazing for Apple, but nothing lasts forever.

Featured image from Shutterstock.