Stock News

Why Does the Price of Oil Go Crazy?

The price of oil is going through a veritable roller coaster ride. In July, there was a strong setback. The international oil cartel, the OPEC, decided to gradually increase production. Russia also turned on the valve. On top of that, some unscheduled delivery failures that existed in Libya had to be repaired.

But the correction seems to be over for the time being. Only the North Sea brand Brent climbed very quickly in the direction of $80 a barrel. And now there are new events. Now it is the US sanctions against Iran that are increasingly attracting investors.

The country, which incidentally is also a member of OPEC, will not be allowed to export any more oil from November of this year. And that could have serious consequences for the price of oil, at least that’s the fear of many investors.

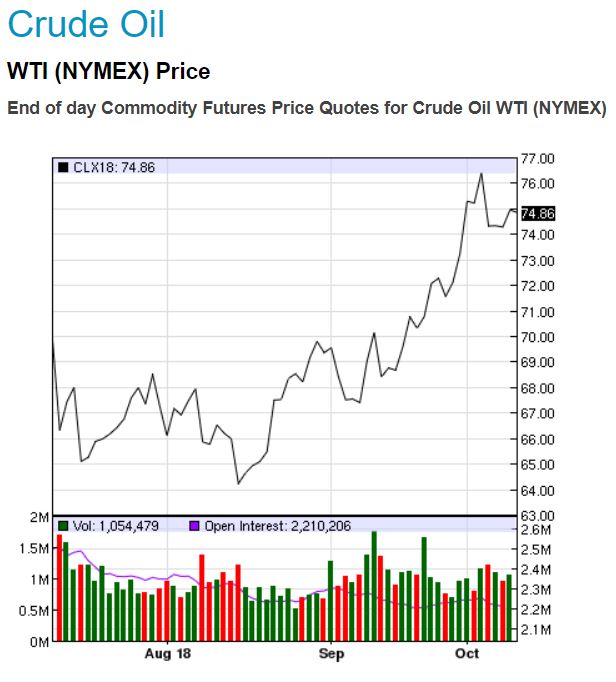

Crude Oil Price https://www.nasdaq.com/markets/crude-oil.aspx

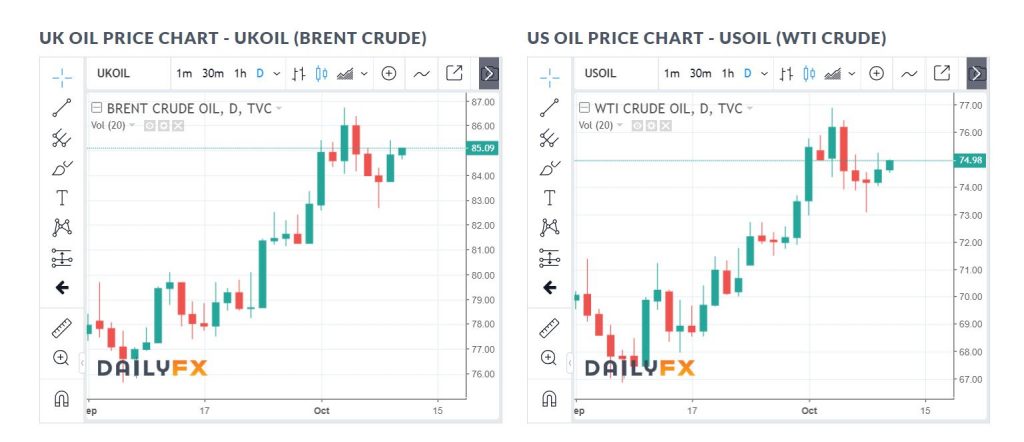

What has been happening since mid-August in the oil market you don’t get to see so often. The price of Brent, which is relevant in Europe, has risen by 20%, to $84.6 a barrel. Since the beginning of the year, there has been 27% growth, since the middle of last year over 85%.

Certainly, given the fact that the price had plummeted in the previous years from $115 (mid-2014) to under $30 (January 2016), the current backlash is partly also a correction.

On the one hand, there is the booming economy, which boosts oil consumption and thus drives up the price.

And here comes the second reason into play. Traders fear a further decline in supply. This is limited only by the fact that oil production is falling in Venezuela due to the economic crisis.

Now the situation around Iran, the third largest producing state within the OPEC oil cartel, is also getting worse. The US imposed new sanctions on the Mullah regime. These will not come into effect until the beginning of November, but they cast their shadows. Russian Minister of Energy Alexander Novak said:

“The market is very nervous and very emotional.”

The fast price dynamics are not even pleasing production countries, let alone the consumers. This can be seen from various statements. For instance, US President Donald Trump has repeatedly complained that the OPEC needs to take responsibility for regulating the price. That is only partially true.

The cartel in alliance with Russia and some other oil states at the end of 2016 agreed on funding cuts. Due to the new market situation at the beginning of this summer, however, the taps turned up again.

The two largest producers Russia and Saudi Arabia said they were ready to do more if needed. But at least, as far as Russia is concerned, there are doubts as to whether it can further increase its historic maximum funding.

And so the price forecasts of $100 a barrel are increasing in the face of this mishap situation. According to Novak, the price range of $65 to $75 a barrel appears to be at a suitable level for both producers and consumers. We can already see that price is following his predictions.

Crude Oil Price / https://www.dailyfx.com/crude-oil

Gasoline, Heating Oil and Gas Getting More Expensive

The average price of gasoline worldwide is $1.18 per liter. Due to the higher oil price, the consequent increase in fuel prices is already being observed. Although it’s still a bit early to think of the dark season, in terms of electricity and gas price, we can already feel it in the air.

Price increases indicate the turn of the year. Both heating oil and gas are becoming more expensive than last year in many regions. We must prepare to live in the new era of high prices.

Featured image from Shutterstock.