Gustav Magnar Witzøe (GMW) has an estimated $3 billion USD to his name. And a mountain of salmon. He’s the third-youngest billionaire on earth. The youngest...

Wealth worldwide is unevenly distributed and it’s accumulating more and more in Asia. Compared to the previous year, the number of those who own $5 million dollars...

Every crash in the financial market brings tough days for billionaires, often wiping out fortunes. But since almost every billionaire’s wealth is linked to the stock market and...

The retail situation in the US looks nasty. Failing anchor stores like Sears and Toys R Us are symptoms of what could be the biggest contraction...

Mohammed Dewji, believed to be the youngest billionaire in Africa, was kidnapped during his regular gym visit in the early hours of Thursday, October 11, 2018....

They say that money makes the world go around. While India’s sure got its fair share of people (over 1.3 billion on the last count), the...

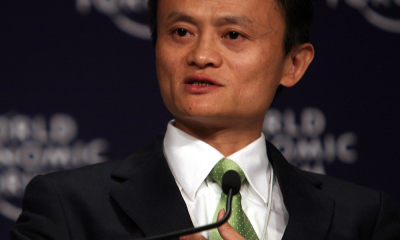

Even before the Asian stock markets reacted to the US stock market plunge yesterday, the number of billionaires in China had become fewer in 2018. The...

It looks like the haves (as opposed to the have-nots) found a new accessory for their multi-million dollar vacation homes. The Hamptons has been a destination...

Elon Musk has been having a rough time recently. After the classic “Joe Rogan-smoking blunts debacle” and calling one of the heroic Thailand cave divers a...

When everyday people have money problems, it’s usually something on the frontline like struggling to pay monthly bills and so forth. When a Russian billionaire such...